Artist in Residence for The Bureau of the Public Debt

If debt is valuable to banks, corporations, and governments, why not to individuals?

Our country was founded on debt. At the end of the Revolutionary War, the United States government had a colossal war debt and each state had a different form of currency. Alexander Hamilton conceived of a central bank and a way to use debt to solidify it’s power. The federal government paid off all of the state’s debts at full value and issued new securities, government bonds. Investors who purchased these public securities could make enormous profits when the time came for the United States to pay off these new debts. In this way, Hamilton took debt and created a mutually beneficial plan whereby a strong central bank was created and investors would receive profits on their bonds. He used debt to expand capital for growth and to create profit.

“The United States debt, foreign and domestic, was the price of liberty. The faith of America has been repeatedly pledged for it… Among ourselves, the most enlightened friends of good government are those whose expectations of prompt payment are the highest. To justify and preserve their confidence; to promote the increasing respectability of the American name; to answer the calls of justice; to restore landed property to its due value; to furnish new resources, both to agriculture and commerce; to cement more closely the Union of the States; to add to their security against foreign attack; to establish public order on the basis of an upright and liberal policy; these are the great and invaluable ends to be secured by a proper and adequate provision, at the present period, for the support of public credit.” Alexander Hamilton, 1790, First Report on the Public Credit

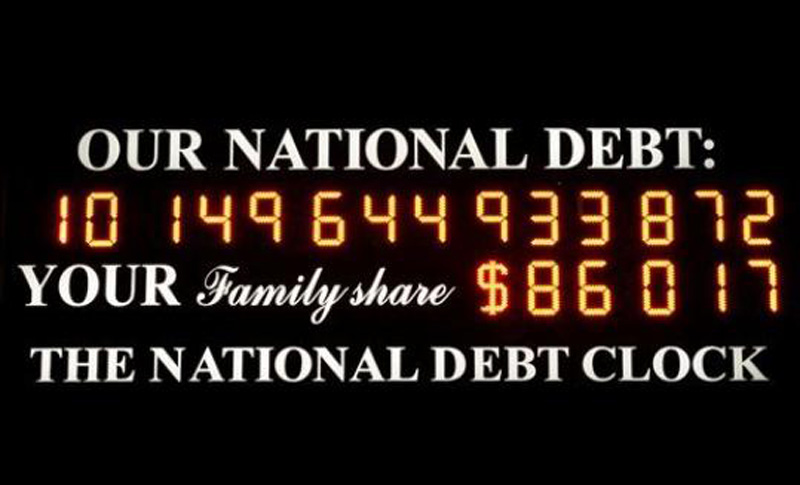

From the website of The Bureau of the Public Debt:? What we Do: Our job is to borrow the money needed to operate the federal government and to account for the resulting debt. In a nutshell, we borrow by selling Treasury bills, notes, and bonds, as well as U.S. Savings Bonds; we pay interest to investors; and, when the time comes to pay back the loans, we redeem those securities. Every time we borrow or pay back money, it affects the outstanding debt of the United States. We also provide reimbursable administrative and information technology services to other government agencies through our Administrative Resource Center (ARC).

In the recent financial crisis of 2008, banks were bailed out by the government. Simultaneously, individuals who lost homes and jobs were forced into desperate circumstances. People ran up credit bills due to illness and the loss of a job as well as faulty financial management. Often, the same circumstances that led them to credit make it impossible for them to pay these bills down. Meanwhile, the banks profit from this debt. Could there be a way for individuals to profit from their debt and give back to their communities at the same time?

As the Artist in Residence for the Bureau of the Public Debt, I will try to create solutions that would enable individuals to pay down their debt while performing some type of community service. In this way, people might receive a helping hand from the government while contributing to their local community. In essence, this would be a barter system. An individual credit card debt would be gradually eroded through service to the community. This give back program might include community gardens, classes on nutrition and healthcare, and teaching skills that are job-related such as computer software and accounting. Other services might include rides for senior citizens, delivering food to seniors, counseling and therapy, classes in artmaking, from studio art to playing the guitar, sewing and cooking classes, car maintenance, resumé writing, etc. The list goes on and on. A particular individual’s skills could be bartered for payment to credit card companies. This program would be one step away from the government bail-out of the banks. If the government can loan money to banks, why not loan money to individuals who can pay down their debt to the bank through community service.

Part of the responsibility of the Bureau of the Public Debt is to distribute new technology to government?offices. In line with this role, I would like to create a database of community needs and individuals with skills to meet them. This database could be used to match up the two.

As Artist in Residence of the Bureau of the Public Debt, I would continue to try to come up with?innovative ways for individuals to pay off credit card debt in accountable, concrete ways that are beneficial to themselves and their community. Freed from the burden of debt, they could use their financial resources to build a better future.